The short answer: Electronic signatures are legally binding in the United States and many other countries.

Electronic signatures have become a common part of daily life. From clicking “I Agree” on an online form to signing legal documents remotely, we have changed how we handle contracts and other paperwork. But for many legal professionals, there’s still confusion about what makes an electronic signature valid — and when it can be challenged.

E-signatures carry the same legal effect as handwritten ones, provided they meet certain conditions. Whether you’re signing a lease, finalizing a personal injury settlement, or onboarding a new client, an electronic signature can hold up in court just like ink on paper.

Fortunately, both federal law and state law provide a strong legal framework to support electronic records and digital transactions. In the United States, two primary laws govern this area:

The Electronic Signatures in Global and National Commerce Act (ESIGN Act)

This federal law confirms that electronic contracts and signatures have the same legal effect as their paper counterparts, and they cannot be denied validity solely because they are in electronic form. The ESIGN Act applies nationwide, including in interactions with the federal government and agencies, unless specific exceptions apply.

The Uniform Electronic Transactions Act (UETA)

UETA is a model state law that establishes the legal validity of electronic signatures and records for transactions at the state level. It has been adopted in 49 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. New York is the only state that has not adopted UETA; instead, it follows its own electronic signature law with similar legal recognition.

Together, the ESIGN Act and UETA ensure that electronic signatures are enforceable and legally valid across nearly all U.S. jurisdictions.

Contents

2025 Regulatory updates

The landscape for electronic signatures continues to evolve. As of early 2025, several regulatory developments are worth noting:

- The American Bar Association’s updated Model Rules of Professional Conduct include specific guidance on attorney use of electronic signatures in client agreements.

- Several states have amended their UETA implementations to address blockchain-based signatures and smart contracts.

- Federal courts continue to expand the use of electronic signatures through updated guidance and technological modernization efforts.

These updates reflect the growing sophistication of digital transaction technologies and provide additional clarity for legal practitioners.

How electronic signatures work

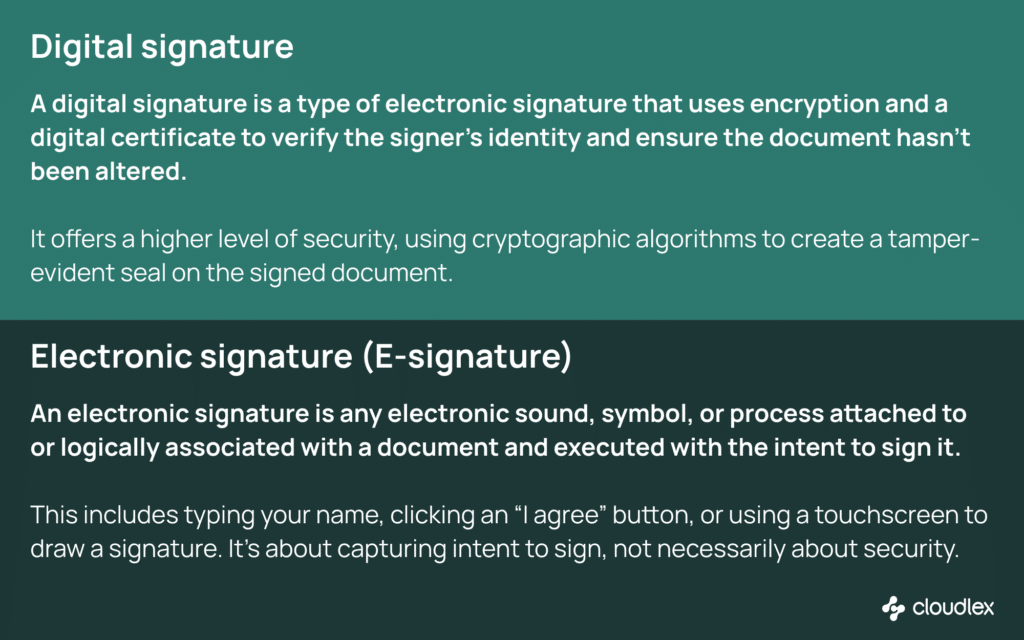

An electronic signature is any electronic sound, symbol, or process attached to a document and executed with the intent to sign. This means you don’t have to “draw” your name to sign electronically — even clicking a button can count as long as it shows clear intent to sign.

Examples of valid electronic signatures include:

- Typing your name into a form field

- Drawing a signature with a mouse or touchscreen

- Using voice or fingerprint recognition

- Clicking a checkbox labeled “I agree to the terms”

These actions are often recorded in an electronic record, which tracks the signer’s identity, the electronic document that was signed, and the method used to sign. Most modern platforms also provide an audit trail showing timestamps, IP addresses, and identity verification steps, which strengthens the legal effect of the signature.

A digital signature, while often used interchangeably with electronic signature, is technically more secure. It uses encryption methods and a digital certificate issued by a trusted authority to confirm the authenticity of the signer. Many systems now include multi-factor authentication and reasonable steps like email verification, passcodes, or biometric scans to ensure that the electronic identification is accurate.

Legal frameworks and compliance across jurisdictions

United States

The ESIGN Act and UETA work together to ensure electronic records and digital documents have the same legal status as paper. UETA has been adopted by 49 states and territories, including Puerto Rico, while New York follows its own version with similar principles.

These laws establish that:

- A document or signature cannot be denied legal effect because it is in electronic format A valid electronic signature must be associated with the act of signing

- All parties must consent to use electronic means

Compliance is also required by various governmental agencies such as the IRS, Social Security Administration, and Department of Labor. These entities often require electronic records for filings and documentation, provided specific technical and security requirements are met.

European Union & United Kingdom

Internationally, the eIDAS Regulation governs electronic identification and trust services in the European Union. It recognizes three types of electronic signatures:

- Electronic Signature

- Advanced Electronic Signature

- Qualified Electronic Signature (QES)

A qualified electronic signature has the highest level of legal status and is backed by a digital certificate issued under strict supervision. It’s legally equivalent to a handwritten signature across all EU member states.

The United Kingdom, post-Brexit, has maintained its own version of eIDAS but largely follows the same structure. As global digital transactions become more common, understanding cross-border compliance is essential for any law firm dealing with international clients or agreements.

When are electronic signatures accepted (or rejected)?

Most of the time, electronic signatures are accepted as legally binding — especially when an electronic contract is clear, voluntary, and meets security standards. However, there are certain situations where electronic signatures may not be accepted or may require additional requirements to hold up in court.

Common examples of acceptance:

- Signing NDAs, retainer agreements, or settlement releases

- Executing contracts via email or online platforms

- Filing documents with a governmental agency

Where electronic signatures might not apply:

- Wills and testamentary documents (varies by state)

- Certain real estate transfers

- Court documents requiring notarization

To improve enforceability:

- Always maintain an audit trail

- Use systems that verify the signer’s identity

- Save electronic records in secure, compliant systems

- Understand each jurisdiction’s legal requirement for electronic signatures

Remember, courts often look at whether reasonable steps were taken to confirm the signer’s intent and identity. A failure to meet these standards could affect the signature’s legal effect, especially if one party disputes the validity of the signed document.

How to implement secure and compliant electronic signatures

Law firms and legal professionals can confidently use electronic signatures — but only if done correctly. Whether you’re dealing with legal documents, personal injury cases, or business agreements, there are best practices to follow.

Choose trusted tools and providers

Use electronic signature platforms that comply with the ESIGN Act, UETA, and eIDAS Regulation. These should offer:

- Built-in audit trails

- Multi-factor authentication

- Encryption and tamper-evident seals

- Support for digital certificates

Match the level of security to the legal need

For basic agreements, a simple electronic signature may be enough. For more sensitive documents, consider using an advanced electronic signature or even a qualified electronic signature backed by a trust services provider.

Store documents securely

Every signed document should be stored as an electronic record in a way that preserves its integrity and provides access if needed later. This is especially important for firms handling governmental affairs or contracts involving the federal government.

How personal injury practices are using e-signatures

- HIPAA Compliance: Medical record releases must utilize HIPAA-compliant e-signature solutions to protect patient privacy.

- Settlement Agreements: These often require additional identity verification measures, such as multi-factor authentication, to ensure enforceability and withstand potential challenges.

- Statute of Limitations: Accurate timestamping of electronic signatures is crucial to demonstrate the timely execution of documents within statutory deadlines.

- Contingency Fee Agreements: Courts have generally upheld electronically signed contingency fee agreements, provided they meet legal standards for validity and consent.

From solo attorneys to enterprise law firms, understanding how to use e-signatures correctly can save time, reduce errors, and support the enforceability of your agreements.

By following established legal frameworks, securing your processes, and using reliable tools, you can be confident that your electronic contracts, digital documents, and electronic records hold up where it matters most—legally.

Bring e-signatures into your workflow with CloudLex

Adding electronic signatures to your day-to-day legal operations is easier when they’re already built into the tools you use. That’s where LexSign comes in — a secure, HIPAA-compliant e-signature feature designed specifically for law firms. With LexSign, attorneys can send documents for signature, monitor progress, and manage signed records — all within CloudLex’s unified platform.

Prefer working with industry-standard solutions? CloudLex also connects with trusted providers like Adobe Sign and DocuSign, making it simple to work with the tools your firm already knows. Whether you’re collecting client authorizations or executing time-sensitive agreements, CloudLex helps you keep everything moving — efficiently, securely, and in one place.